BTC remains attractive to seasoned hodlers as $50,000 for bitcoin is now the point at which confidence can turn into worry. BTC hovered around $54,000 on Nov. 28 as the upcoming weekly close showed signs of hitting two-month lows. Details Cryptocoin. com

at .

Levels for bitcoin

Buyers are seen willing at $53,000. The pair dropped below a major support zone on weekly timeframes, opening up the potential of weekend lows since late September. For trader and analyst Rekt Capital, $55,800 must be demanded back to reverse this, something that could still “easily” happen.

https://twitter. com/rektcapital/status/1464693553972584454

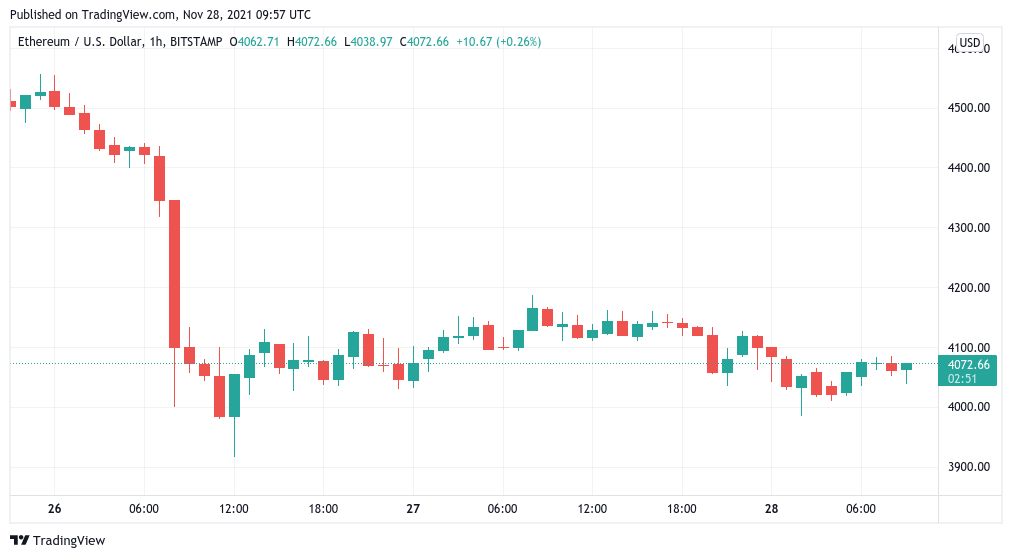

On Sunday, Alex Mashinsky, founder and CEO of crypto lending platform Celsius, confirmed that it has added both Bitcoin and Ether (ETH) to its allocations. He told his Twitter followers:

I bought around $10M worth of BTC and ETH at current levels to add to my positions. We may see a retest of $53,000 for BTC and $4,000 for ETH, but these should be short-term bottoms and we can get back to $70,000 from there.

Mashinsky added that if BTC/USD drops below $50,000, he will sell 50% of his recent purchases. Separate data compiled by analyst Willy Woo, meanwhile, strengthened interest in buying Bitcoin at current levels.

https://twitter. com/woonomic/status/1464596320983814153

Amid the ongoing uncertainty over the latest Coronavirus strain, there has been little delay in sales since Friday. This caused immediate discomfort in both crypto and traditional market sentiment as the Crypto Fear & Greed Index returned to the “extreme fear” territory. As such, the major altcoins showed no signs of recovery as the weekend ended, with the top ten cryptocurrencies by market cap noticeably in the red on their weekly timeframes.