Yatırım Finansman and Info Yatırım evaluated November industrial production with short notes. According to Yatırım Finansman, the economy will bid farewell to 2022 with a very weak closing. Info Investment, on the other hand, claimed that industrial production will regain strength in 2023 with government incentives.

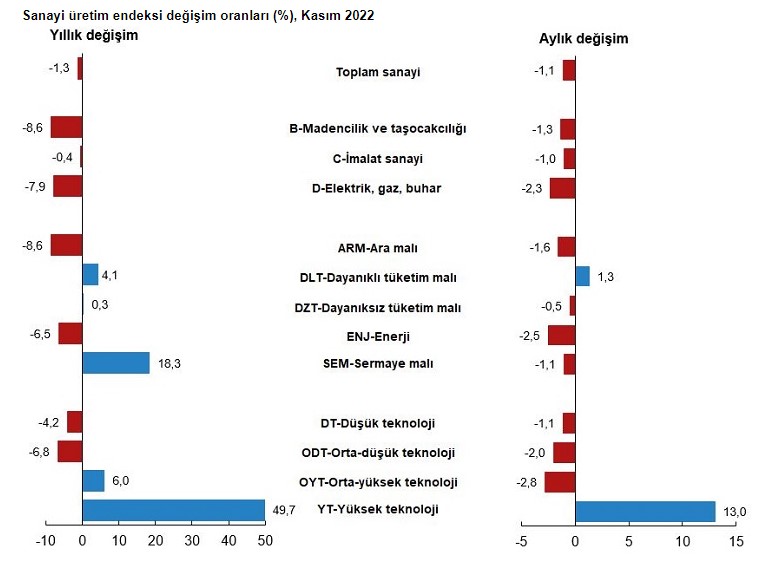

According to the Yatırım Finansman report, industrial production contracted by 1.1% monthly and 1.3% annually in November. Consensus expectations were for Industrial Production to increase by 0.1% YoY. In addition, the annual change in unadjusted figures was -1.2% (Nov.21: +14.6%).

While a decrease was observed in all sectors on a sectoral basis in November, the strongest monthly contraction was realized in electricity, gas and steam sectors with 2.3%. This was the 4th consecutive month of contraction in the sector. Manufacturing and mining-quarrying sectors contracted by 1.0% and 1.3%, respectively, on a monthly basis. This was the 6th month contraction observed in the last 7 months in the mining-quarrying sector. On the basis of main industry groups, only durable goods grew on a monthly basis, while intermediate, non-durable goods, energy and capital goods contracted. Intermediate goods, capital goods and non-durable goods contracted in 2 of the last 3 months. Let’s also note that the energy group has contracted for the third consecutive month.

The manufacturing sector contracted 1.0% monthly and 0.4% year-on-year. A monthly increase was observed in 10 of the 24 sectors under the manufacturing sector. Looking at the sub-sectors, the highest monthly increases are in the manufacture of computers, electronics and optical products (+20.4%), the manufacture of basic pharmaceuticals (+3.2%) and the manufacture of coke and refined petroleum products (+2.5%). ; The sharpest declines were in the manufacture of other transportation vehicles (-23.4%, up 53.2% in the previous month), printing and reproduction of recorded media (-7.9%) and base metal manufacturing (-6.5%). The strong increases observed in the manufacturing of computer, electronic and optical products for the second consecutive month are remarkable (28.0% increase in October and 20.4% increase in November on a monthly basis).

Economic growth may remain weak in 4Q22

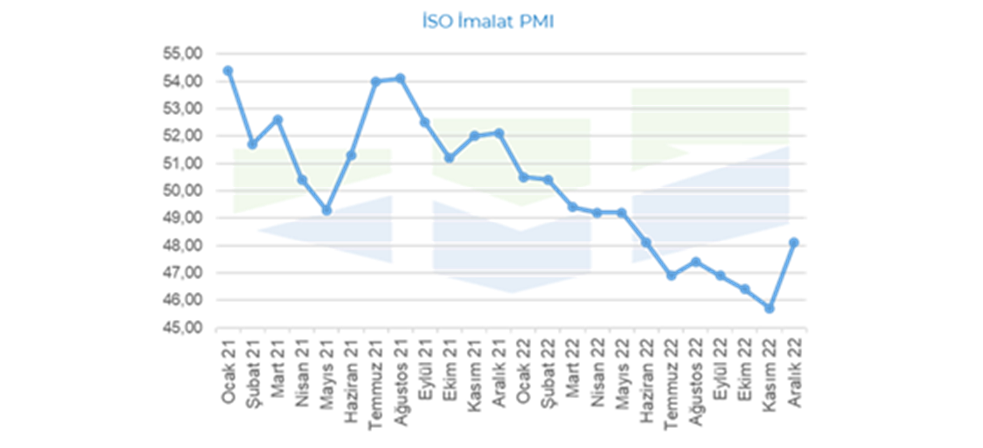

Economic growth may remain weak in 4Q22. This was the second data for Industrial Production for 4Q22, one of the most important leading indicators of economic growth. In November, industrial production contracted for the first time since June 2020 and July 2021 in both the unadjusted and calendar adjusted series, respectively. Therefore, it can be said that the November data limited the positive outlook that the October data pointed to for the 4Q22 period. Other leading indicators and high-frequency data such as manufacturing PMI and electricity consumption show that economic activity continued to lose momentum in the 4Q22 period after 3Q22. Manufacturing PMI, which was 48.1 in December, has remained in the contraction zone for the last 10 months (March-December). The main determinant of this trend can be seen as the loss of momentum in both domestic (high inflation environment eroding purchasing power and the effect of forward demand) and external (tightening global financial conditions, slowdown in Europe, our most important foreign trade partner).

Moreover, we think that the measures taken for loan growth will put some downward pressure on domestic demand in 4Q22. The third and final industrial production data for 4Q22 (December) will be released on February 10.

Info Investment: KGF package encourages industrial production

The following comments were included in the Info Investment note: Industrial Production turned its direction up again in October after the fall in September.

While the latest November data decreased by -1.3% on an annual basis and -1.1% on a monthly basis, the October data was revised from 2.5% to 3.2%.

While the positive contribution of consumption expenditures, which was brought forward especially in 2022, to growth decreased; it is positive that the new KGF package supports growth in terms of timing.

Looking at the industrial production data in detail, there was a decrease in all goods groups except high technology and durable consumer goods.

In the upcoming period, the relationship between growth and industrial production is expected to continue upwards, as implied by the latest ISO manufacturing PMI data, and industrial production and industrial GDP data are expected to increase with the new KGF package.