[ad_1]

While markets are going up, people get more comfortable putting their cryptoassets into trusted third parties such as centralized exchanges and centralized lending platforms that promise increasingly enticing returns. The good times never last, though. As markets peak and monetary policy tightens, companies that overleveraged on the way up expose themselves to liquidity risks. If you deposited your cryptoassets into these products, perhaps unaware of their risk taking, your assets are exposed to their risks.

Not Your Keys, Not Your Coins

Pretty much everyone in crypto has heard this phrase at this point. This phrase is most applicable in the current market environment. Crypto and traditional markets are currently undergoing a contraction. During every contraction, whether it is in crypto or traditional markets, highly leveraged businesses have a greater chance of failing. Even worse, there have been countless stories of unscrupulous companies reaching for their customers’ funds to paper over the cracks.

We highly recommend for people to move your funds off of centralized services into self-custodial wallets (sometimes called non-custodial). Make sure it’s truly self-custodial, or you still don’t have complete control over your assets. Read more about the difference between custodial and self-custodial wallets here.

Risk Exposure to Failing Crypto Products

Self-custody doesn’t completely protect from risks associated with failing projects. We saw this spectacularly with LUNA/UST a month ago. However, there is a difference between custodial and self-custodial projects. The risks of LUNA/UST were apparent for many to see because the finances were mostly on-chain, transparent and free for anyone to observe. Despite that, plenty of participants, both retail and “sophisticated” institutional users were wiped out.

A far worse problem is the centralized crypto products because their finances are shrouded in mystery. It prevents any foreknowledge of their impending problems until it suddenly blows up. This is already unfolding now.

Celsius Network, a centralized borrow/lend crypto platform suddenly announced on June 13 that they were freezing customer assets. This was especially shocking given their CEO’s tweet responding to rumors of freezing customer withdrawals the day before.

Mike do you know even one person who has a problem withdrawing from Celsius?,

why spread FUD and misinformation.

If you are paid for this then let everyone know you are picking sides otherwise our job is to fight Tradfi together…

— Alex Mashinsky (@Mashinsky) June 11, 2022

.@CelsiusNetwork is pausing all withdrawals, Swap, and transfers between accounts. Acting in the interest of our community is our top priority. Our operations continue and we will continue to share information with the community. More here: https://t.co/CvjORUICs2

— Celsius (@CelsiusNetwork) June 13, 2022

This caused a market wide sell-off, during which centralized exchange Binance, the world’s largest crypto exchange, announced the “temporary pause of bitcoin withdrawals.”

Temporary pause of $BTC withdrawals on #Binance due to a stuck transaction causing a backlog. Should be fixed in ~30 minutes. Will update.

Funds are SAFU.

— CZ 🔶 Binance (@cz_binance) June 13, 2022

Since then, there have been alleged stories of Celsius customers having their collateral liquidated despite having sufficient assets to re-collateralize loans. They were unable to do so due to the account freezing. On June 15, The Wall Street Journal reported that Celsius had hired restructuring lawyers to “advise on possible solutions for its mounting financial problems.” For Celsius’ customers, the terms of use indicate their funds could be forfeit:

In the event that Celsius becomes bankrupt, enters liquidation or is otherwise unable to repay its obligations, any Eligible Digital Assets used in the Earn Service or as collateral under the Borrow Service may not be recoverable, and you may not have any legal remedies or rights in connection with Celsius’ obligations to you other than your rights as a creditor of Celsius under any applicable laws.

Meanwhile, rumors began to circulate on June 14 that famed crypto hedge fund, Three Arrows Capital (3AC) was insolvent. Like Celsius, 3AC had sequestered a large amount of ETH into stETH. The problem with stETH is that, while a secondary market is available to trade the staking derivative, it is far less liquid than ETH. While Celsius was attempting to find liquidity by selling stETH, 3AC sold much more. On June 15, rumors of 3AC solvency problems were confirmed with co-founder Su Zhu’s tweet.

We are in the process of communicating with relevant parties and fully committed to working this out

— Zhu Su 🔺 (@zhusu) June 15, 2022

Self-Custody Is Insurance

While it’s impossible to know if there will be contagion or how far it could spread (hopefully we’ve already seen the worst of it!), one thing is certain: if you self-custody your crypto, you will have much greater control over your money during up and down times.

Self-custody is certainly more than insurance, however, its role as insurance is critical. It is insurance against third parties, whether they be financial institutions or governments. All insurance comes with a premium, and self-custody is no different. In this case, it is paid in the form of personal responsibility, but the benefit is peace of mind.

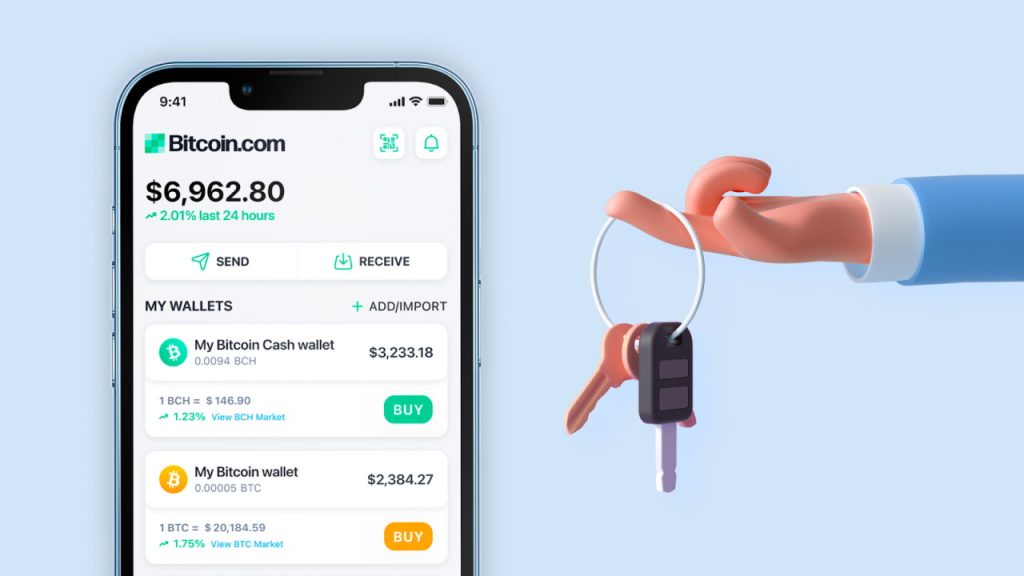

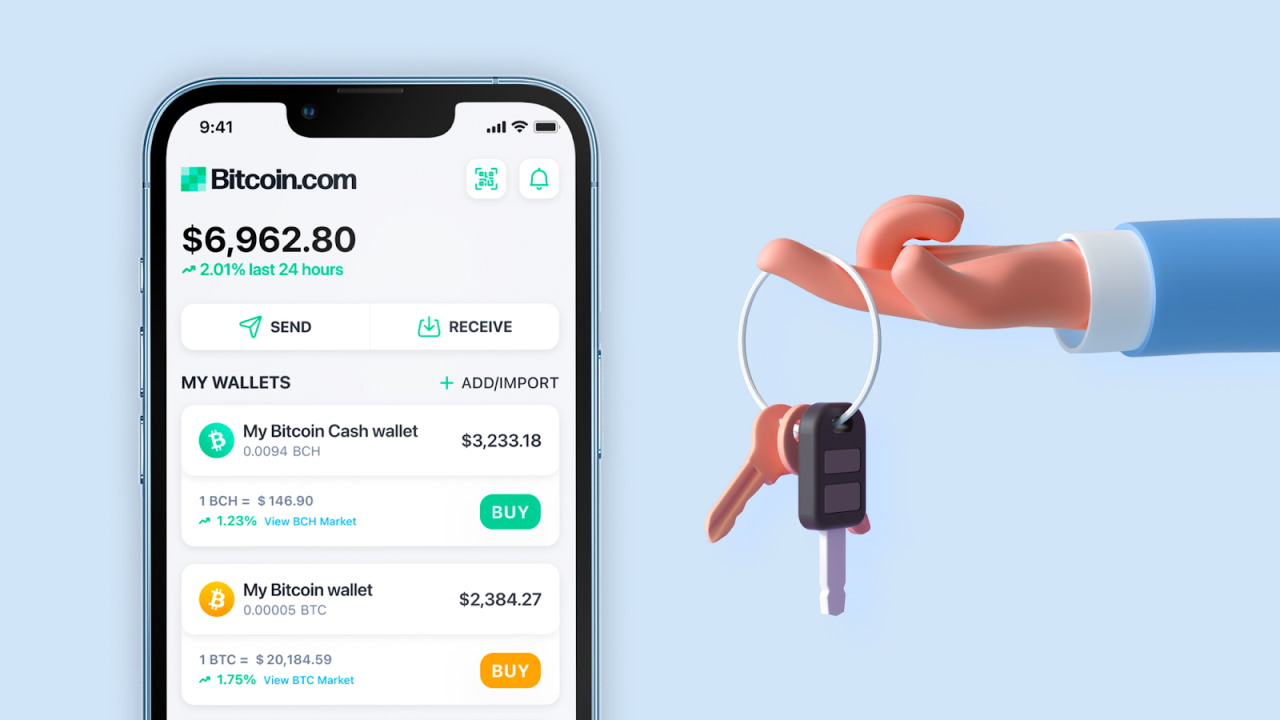

Bitcoin.com’s mission is to create economic freedom, which is why we dedicate the majority of our resources to development of the fully self-custodial Bitcoin.com Wallet and other self-custodial products like the Verse DEX. Use them to take control of your Bitcoin, Bitcoin Cash, Ethereum, and ERC-20 tokens (support for more chains is on the way!).

Dennis Jarvis is CEO of Bitcoin.com

[ad_2]

Source link