Debates about the nature of inflation are over. The question now is what the end of temporary inflation will mean for gold prices. Market analyst Arkadiusz Sieroń offers two perspectives for this. we too Cryptocoin. com, we have prepared the analyst’s presentation for our readers with the analyst’s narration.

A story of inflation…

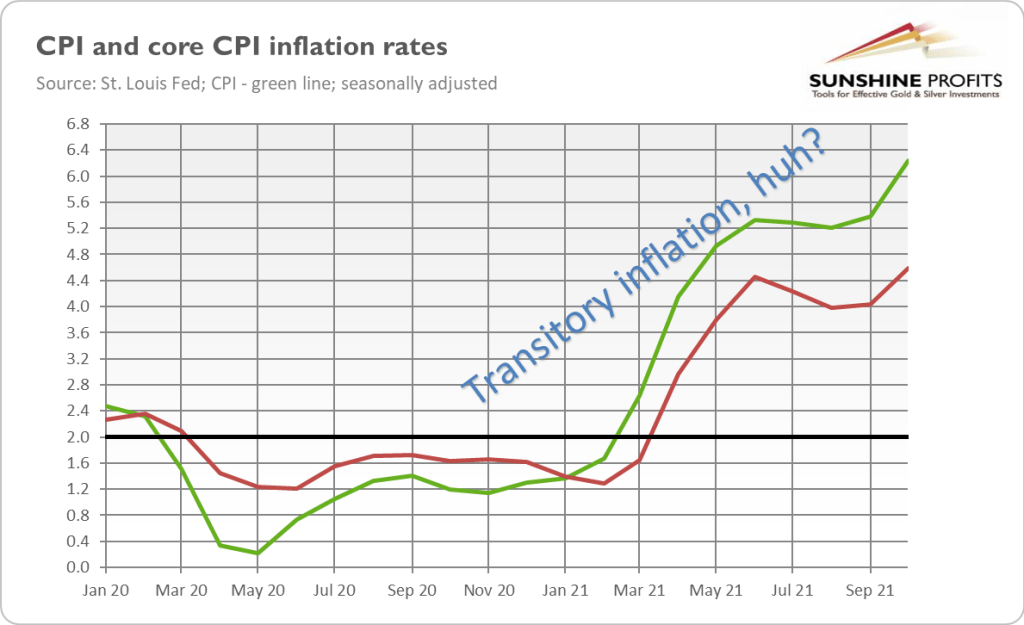

welcome son. Welcome to the inflation machine. Welcome to the new economic regime of rising inflation. It’s official because even central bankers have finally accepted what I’ve been saying for a long time: The current high inflation is not just a temporary one-time price shock. In a statement before Congress, Jerome Powell agreed that the word “temporary” with regard to inflation was “probably a good time to retire.” Well done, Jay! It only took a few months longer than my first year students to realize this, but it’s better late than never. In fact, even a moderately intelligent chimpanzee can look at the graph below and realize that inflation is not just temporary.

To be clear, I am not predicting hyperinflation or even galloping inflation. Nor am I arguing that at least some of the current inflationary pressures will not subside in the next year. No, some supply-side factors behind recent price increases are likely to subside in 2022. However, other factors will persist or even intensify (think housing inflation or the energy crisis).

Let’s be honest: we are facing a global inflation shock right now. Inflation in many countries has reached its highest rate in decades. While the annual CPI rate was 6.2% in the United States, it was 5.2% in Germany, 4.9% in the Eurozone and 3.8% in the United Kingdom. The embarrassing secret is that central banks and governments play a key role in fueling this inflation. As the famous Austrian economist Ludwig von Mises once noticed.

The most important thing to remember is that inflation is not God’s work. Inflation is not a scourge of the elements or a disease that comes like the plague. Inflation is a policy. It is a deliberate policy of people resorting to inflation because they think it is less bad than unemployment. But the truth is that inflation does not improve unemployment over a not so long period of time. Indeed, the Fed and the banking system injected a lot of money into the economy, creating space for the government to increase spending and send checks to Americans. The resulting consumer spending boom has clogged supply chains and caused a spike in inflation.

“Gold prices can benefit from inflation hedge demand”

Clearly, policy makers are unwilling to admit their guilt and involvement with inflation. Initially, they claim that there is no inflation. They then say that inflation may still exist, but that it is only due to the “base effect”, so it will be a short-lived phenomenon only due to the nature of annual comparison. Finally, they acknowledge that there is something beyond the “base effect,” but inflation will be temporary because it is caused by only a few exceptional components of the overall index, outliers such as used cars this year. Then there is nothing to worry about.

Higher prices are the result of bottlenecks that will soon subside on their own. Later, inflation is considered to be more broad-based and persistent, but it is said to be caused by greedy businesses and speculators who maliciously raise prices. Finally, policy makers present themselves as salvation from the problem of inflation (from themselves in the first place). Brilliant “solutions” like subsidies and price controls are being brought to consumers, further disrupting the economy.

The Fed has recently acknowledged that inflation is not merely temporary, so if the aforementioned plan is sufficient, we should expect to look for scapegoats and possibly interventions in the economy to heroically combat inflation. Gold could benefit from such rhetoric as it could boost demand for safe-haven assets and inflation hedges.

“The bottom in real interest rates may be a strong downward signal for gold prices”

However, the Fed’s capitulation also marks a hawkish shift. If inflation becomes more persistent, the US central bank will need to act more decisively, as inflation will not fall on its own. Faster contraction of quantitative easing and earlier rate hikes means higher bond yields and a stronger dollar, so it’s clearly negative for gold prices.

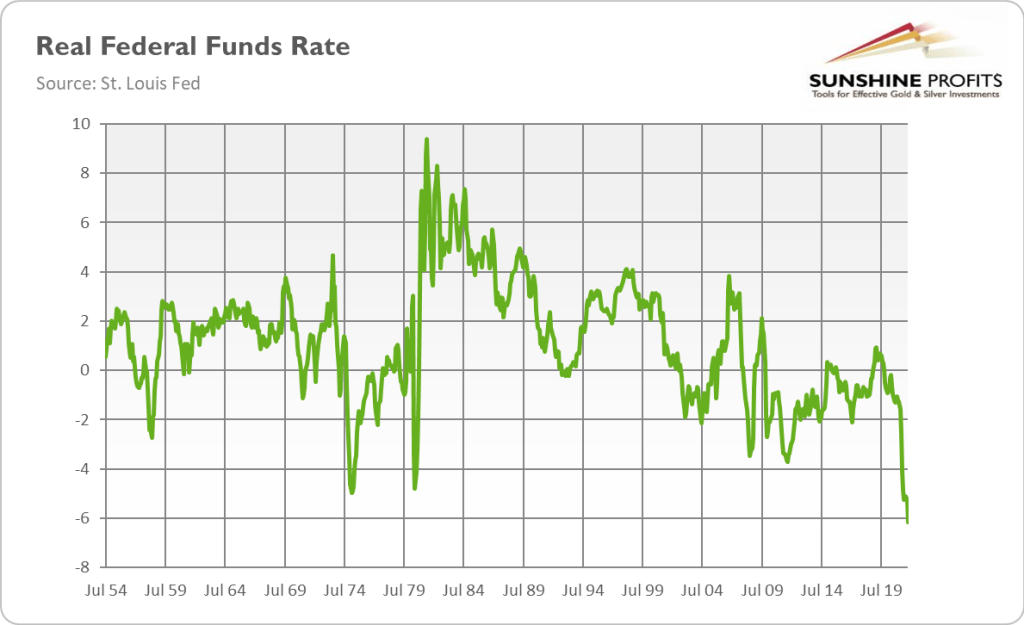

Having said that, the Fed is lagging and will likely lag behind the curve. The real interest rate (that is, adjusted for the annual CPI rate) is currently at -6.1%, the deepest level in history, as shown in the chart below. It is much deeper than in the 1970s at the lowest levels of stagflation and could pose some problems in the future.

The point is that even if the Fed raises the policy rate by one percentage point next year and inflation drops another two percentage points, the real interest rate will only rise to -3%, so it will remain in deeply negative territory. Of course, the upward trend for gold prices will be negative, while the bottom in real interest rates will be a strong bearish signal for gold. However, rates well below zero could provide some support, or at least a reasonable base, for gold prices (i.e. higher than the levels gold touched in the mid-2010s).