The price of gold fell by about 5% in 2021. So it didn’t go well for yellow metal. Unfortunately, according to market analyst Arkadiusz Sieroń, 2022 is not looking better either, especially in the beginning. However, the analyst states that the end of the year gives the precious metal some hope and explains why. we too Cryptocoin. com, we have compiled the analyst’s self-explanatory evaluations and analyzes for our readers.

“High and accelerating inflation has a positive effect on gold price”

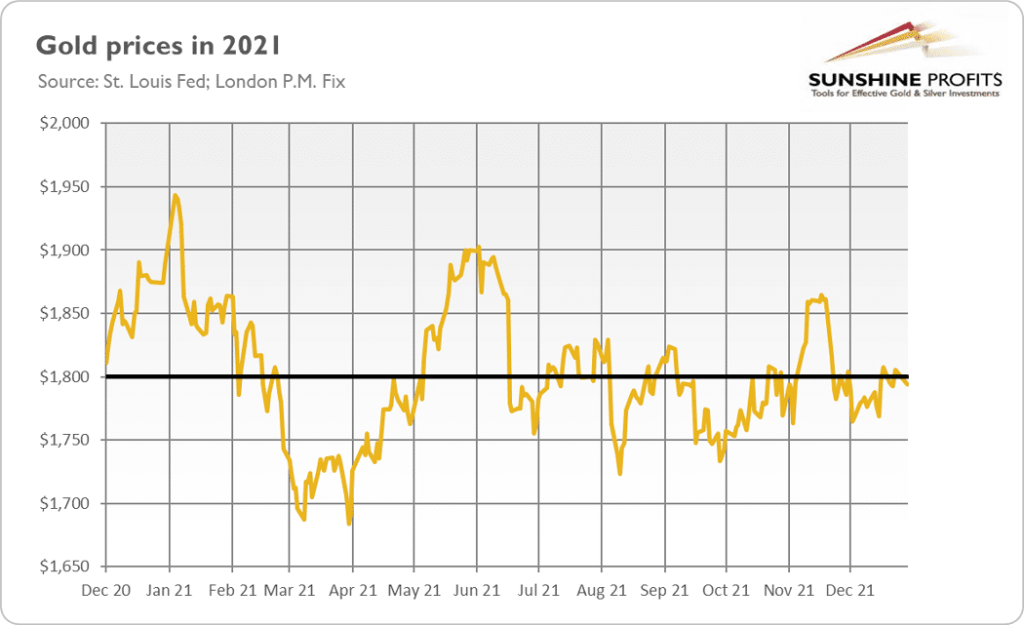

Goodbye 2021! It certainly wasn’t a golden year. As the chart below shows, the yellow metal has lost 5% of its value over the past twelve months, falling from $1,887.60 on December 30, 2020 to $1,825 on December 31, 2021. So I guess the golden bulls won’t miss 2021.

And me? In January, I correctly predicted that “gold’s performance in 2021 could be worse than last year”. However, I was expecting more bullish behavior. I thought that rising inflation would support gold prices more. I am fully aware that gold is not a perfect inflation hedge, but historical analysis shows that high and accelerating inflation should be positive for the price of gold. As a result, inflation lowers real interest rates, which is the key element of the gold market.

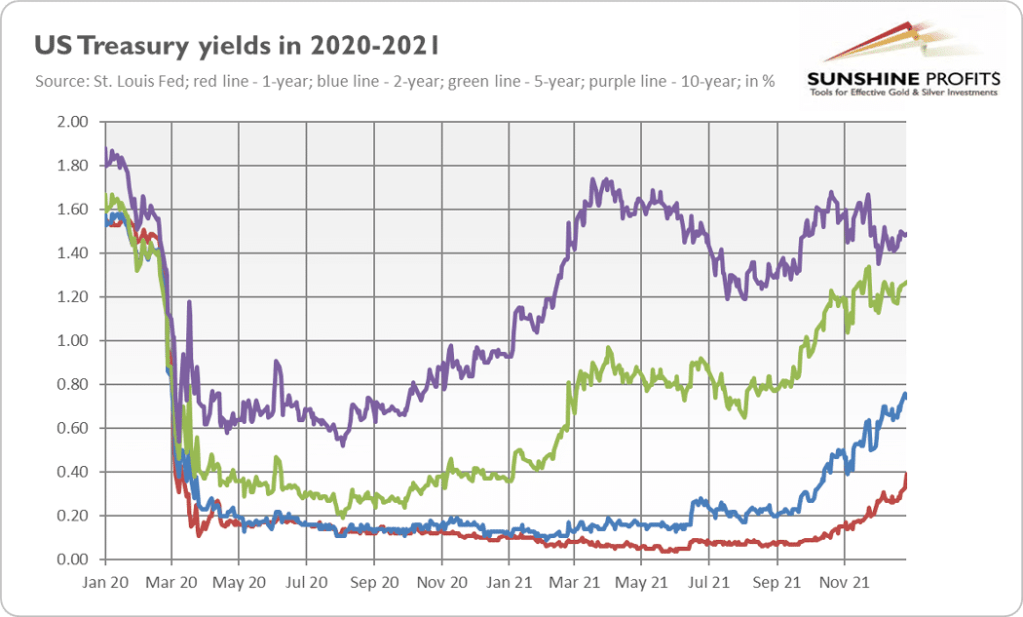

However, rising inflation prompted the Fed to tighten monetary policy and accelerate the contraction of quantitative easing. Expectations for an increase in the policy rate in 2022 also strengthened. As a result, as the chart below shows, especially short and medium-term bond yields rose, putting downward pressure on the gold price. So we learned two important lessons in 2021: Don’t just rely on inflation and don’t fight the (hawk) Fed.

As you can see, bond yields have not yet returned to their pre-pandemic levels. While they do not need to be fully recovered, there is room for further growth. The problem is that when inflation peaks and deflation begins, inflation expectations can fall and raise real interest rates. In fact, market-based inflation expectations peaked in November. This indicates that concerns about inflation have subsided and investors are regaining confidence in the US central bank’s ability to control upward price pressure.

Will 2022 be better than 2021 for gold?

It’s possible, but I’m not optimistic. What I mean here is that macroeconomic conditions will be more bearish for gold. Despite the spread of the Omicron variant of the coronavirus, 2022 could mark the end of the global Covid-19 pandemic with a full economic recovery and a return to normal conditions. Fiscal policy will tighten, the Fed will follow a more hawkish monetary policy than in 2021. Supply shocks are easing, so inflation may peak, real interest rates rise even higher. Also, the US Dollar could strengthen against the Euro as the ECB is slower to tighten its monetary policy.

On the other hand, there are some factors that can support gold prices. In 2021, GDP largely rebounded after the 2020 economic crisis, and financial markets also bounced back strongly. Still, 2022 may prove more challenging for economic growth and the financial sector. One is the base effect, the other is the policy normalization of central banks and rising interest rates. With large public and private debt, the Fed’s tightening cycle could deflate asset and credit bubbles and even trigger a recession or at least a market correction.

However, there are no signs of market stress yet, so my baseline scenario for next year is no financial crisis. 2023 (or later) is a more likely time frame. So, I believe the end of 2022 may be better for gold than the beginning of the year. Because only expectations about the Fed’s tightening cycle can be replaced by concerns about the consequences of interest rate hikes. Anyway, 2021 is (almost) dead. Long live 2022! I wish you back to normal, shiny profits and all the gold next year!