The closely followed crypto analyst InvestAnswers is issuing a warning to Cardano (ADA) investors, saying the sixth-largest cryptocurrency is showing signs of fundamental weakness. In this article, we examine the on-chain metrics of the altcoin project.

Cardano investors think short term

In a new video, crypto analyst InvestAnswers said that Cardano is looking at the speculator chart against its holders and that the data does not look promising for the smart contract platform. Regarding ADA’s on-chain metrics, the analyst says:

Looking at Cardano Blockchain, I’m assuming these are all true, but I’m surprised the percentage of long-term Cardano holders is so low. Only 6.95% of Cardano owners own Cardano for more than a year. This means they have owned it for 12 months or less and 25% are active traders.

Analyst shares second red flag for ADA

Next up, we examine the number of active addresses on Cardano, which the analyst is signaling red flags. Cryptocoin. com InvestAnswers, whose analysis we have quoted, compares ADA and ETH networks:

Now let’s look at active addresses. Another interesting statistic you should research. It’s not just the number of addresses, the on-chain has three million addresses, but only 4% of them are active. And don’t forget that there are 66 million addresses, compared to Ethereum. Despite the large number of long-term owners, they have a good level of activity.

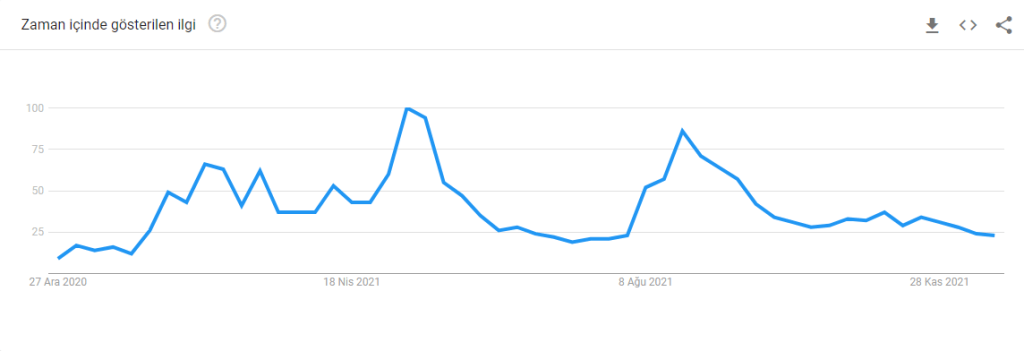

Looking at Google trends, the crypto strategist highlights that retail investors are currently showing little interest in the sixth-largest cryptocurrency:

So let’s look at Google trends. Do people care about Cardano? Google trends, globally, we’re back to one-year lows over the past 12 months. This means that no one is interested in Cardano.

While crypto analyst is bearish on Cardano’s prospects, fellow crypto strategist Capo believes ADA is showing signs of strength after successfully retesting the $1.20 area as support. According to Capo, Cardano is likely aiming for a 580% rally:

As long as it stays above the previous ATH, the next ATH should be $3-4 and if it consolidates above that, we’ll likely see $10.