Gold prices, surrounded by a resurgent dollar, recorded their biggest annual drop since 2015 as investors prepare to enter a new year in which money supply can be tightened even as the threat of the Omicron coronavirus variant persists. Spot gold closed the year at $1,827.21, up 0.75% daily. Analysts share their expectations and interpret the markets. we too Cryptocoin. com, we have compiled the forecasts of its analysts for our readers.

Warren Venketas: Gold can engage in a downhill battle

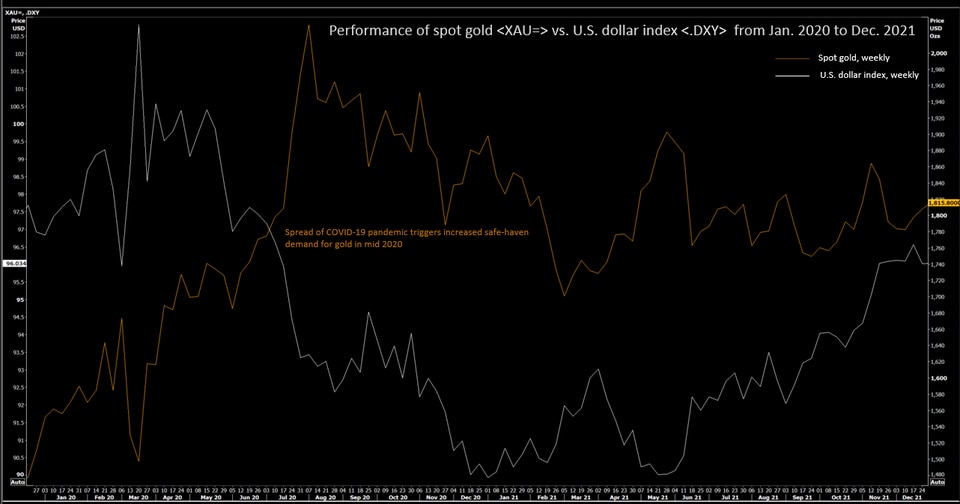

It lost nearly 4% in value as the rebounding global economy in 2021 pushed more investors into riskier assets and reduced interest in safe-haven assets such as bullion. Adding to this mix were indications that central banks would step up to rein in the massive printing of money from the pandemic to stimulate the economy. While bullion is often seen as a hedge against inflation from widespread stimulus, interest rate increases translate into higher opportunity costs of non-interest-bearing gold, pushing up US Treasuries and the dollar. DailyFX analyst Warren Venketas comments:

With US 10-year yields reaching 2% in 2022, with temporary inflation and of course higher interest rates, gold could be in for a downhill battle.

Gold prices fell year-on-year

Gold prices fell year-on-yearExinity chief market analyst Han Tan says concerns about the impact of the Omicron variant could bolster gold, but higher interest rates could undermine its appeal. At the same time, the analyst highlights the following for the precious metal’s outlook this year:

Gold could see several catalysts for significant gains this year, whether it’s a Fed policy error, stubbornly rising inflation, or even an escalation in geopolitical tensions.

Gold will be over $2,000 in 2022, according to Robert Hartmann

Precious metals could rise significantly this year, according to Robert Hartmann, co-founder of precious metals trading firm Pro Aurum, which is assessing the gold markets. The analyst explains the dominant factor of this situation as follows:

Contrary to the usual expectations of significantly lower inflation, inflation reached its highest level in the last quarter century in both Europe and the USA. It is likely that very high inflation will continue all over the world. These high inflation figures will fuel gold prices as a driving force.

After yellow metal’s disappointing performance in 2021, Robert Hartmann looks hopeful for 2022. The analyst predicts that gold prices could reach highs above $2000 again in 2022.

A pessimistic scenario for gold

Credit Suisse analyst Fahar Tariq, on the other hand, thinks that the precious metal prices hovering above $ 1,800 creates optimism and predicts that the yellow metal will average around $ 1,850 in 2022.

Fahar Tariq is not as optimistic as Robert Hartmann because he doesn’t expect prices to be very permanent here. The analyst predicts that prices will decline to $ 1,600 in 2023 and will be traded at $ 1,400 in the long term.

“We can reach the target of $3,000 under it”

Gold Royalty’s David Garofalo, who sees the possibility of a correction in the stock markets rising so fast in 2021 as a support for gold, expects a big move from the precious metal in 2022:

I see no reason why we shouldn’t hit the $3,000 goal below. I believe that what will trigger such an increase will be a correction in the stock markets.

In addition, analysts assess that the ongoing energy crisis in Europe and the escalation of tensions between Russia and Ukraine could be the driving forces for gold as we enter the new year. In addition, they state that the slowdown in economic growth following the rejection of US President Joe Biden’s $2 trillion plan may also support gold.