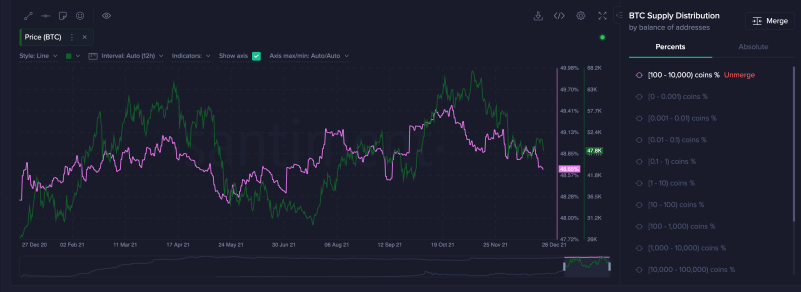

On-chain analytics firm Santiment says in its latest Bitcoin report that whales are selling and individual investors are reluctant to buy. According to the firm, investors are not hopeful enough for 2022 and the number of daily active wallets is increasing. Let’s take a look at Santiment’s answers to all of these.

Bitcoin active wallets hits record

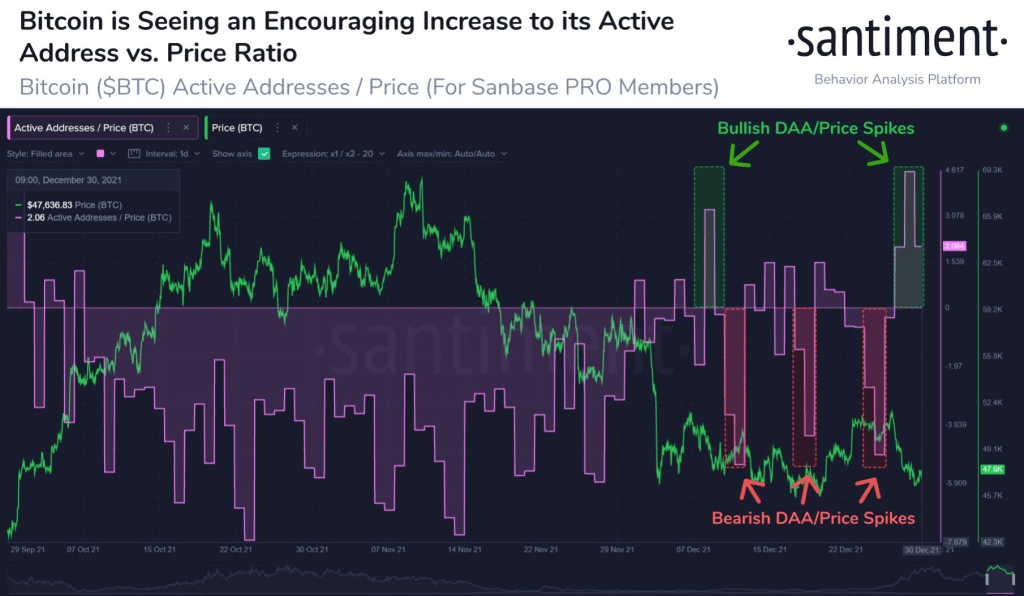

Crypto analytics firm Santiment says the recent increase in the number of daily active Bitcoin (BTC) addresses indicates that the BTC price may be about to move upwards. The firm’s Twitter account tells its 120,700 followers that Bitcoin activity is aggregated after about a month of stagnant data:

We are seeing an increasing trend of address activity as Bitcoin maintains the $46,000 to $48,000 range. December 28 was the highest address activity in 4 weeks, and these high increases in the DAA (daily active addresses)/price ratio are historically linked to price increases.

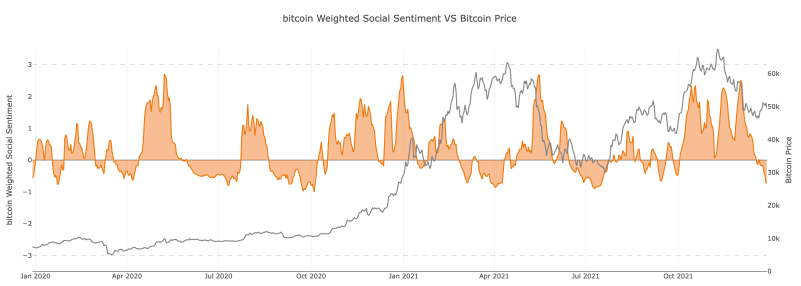

Santiment offers a more in-depth analysis of Bitcoin’s relative strengths and weaknesses in its latest Insights blog post. The firm has this to say on individual investor sentiment as Bitcoin struggles to recapture and hold the $50,000 level:

It seems like a lot of people have lost their magic and are incredulous about getting over $50,000.

According to the firm, individual investors are not enthusiastic about 2022

The crypto analytics firm says that although funding rates are mostly neutral, many are selling their BTC out of fear that it won’t rise in 2022.

People are now selling because they believe there may be more downsides. This is a bearish sign. There are enough people who believe that BTC is not going to rise all next year. They are selling now because they are unsure of long-term waiting.

Cryptocoin. com

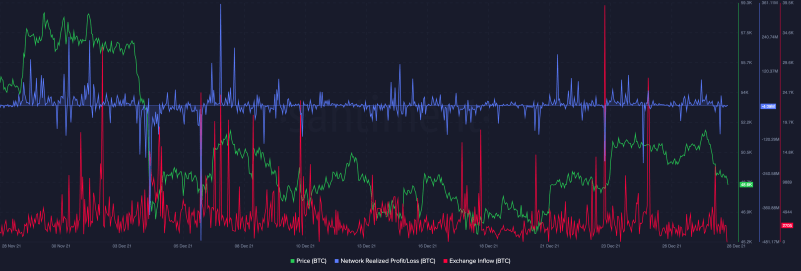

Santiment, whose data we shared , is also concerned about the downward trend in whale activity:

A significant amount of money is drained by these addresses. It’s hard to ascend when whales behave like this.

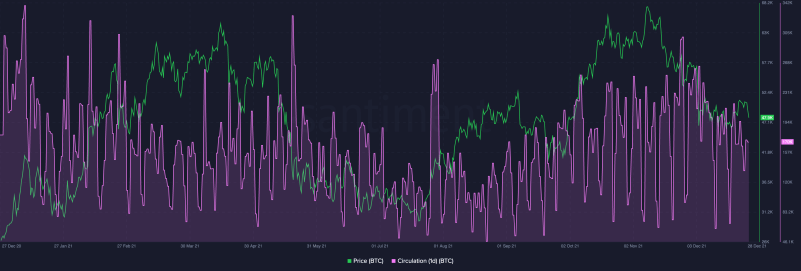

The data firm concludes its analysis of Bitcoin by stating that the daily circulation of BTC has fallen for the past month and a half:

We’ve been seeing a lower peak (LH) in terms of daily circulation every week since November. The amount of Bitcoin used over the network is clearly falling.