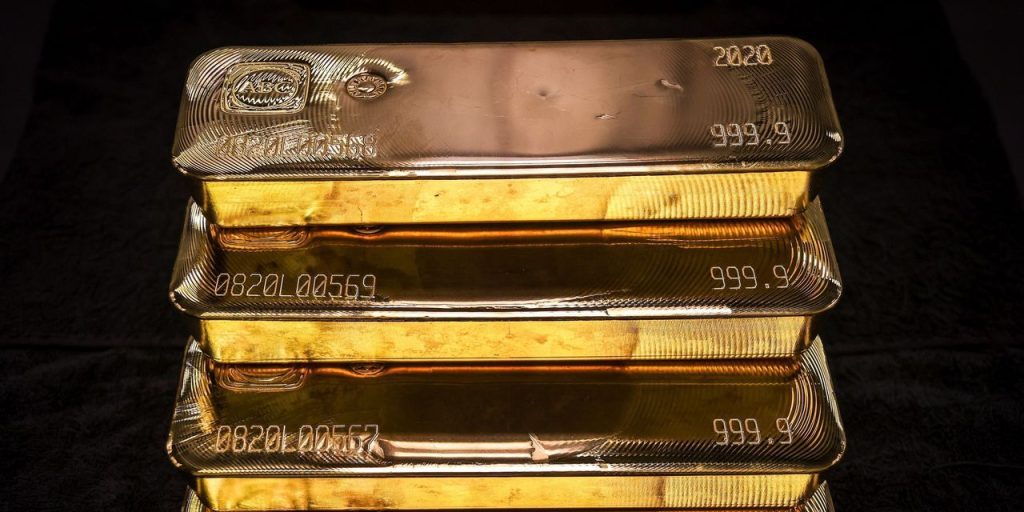

Gold prices do not taste good because there is no clear price direction in the market. Federal Reserve Chairman Jerome Powell’s hawk comments are weighing on the gold market sentiment, according to the latest Kitco News Weekly Gold Survey. Details Cryptocoin. com

at .

Gold prices looking for direction

The latest survey does not show a clear short-term direction for the gold market as prices remain below $1,800 an ounce despite holding critical support levels. Wall Street Analysts are stuck in a triple stalemate on gold’s short-term price outlook for the second week in a row. At the same time, sentiment among retail investors dropped sharply over the past week. Market analysts state that gold is struggling to find new bullish momentum. They said fears of rising inflation were met with expectations that the Federal Reserve could tighten monetary policy faster than expected.

The gold market failed to find a sustainable bid even after weaker-than-expected non-farm payroll data. On Friday, the U.S. Department of Labor said 210,000 jobs were created in November, significantly missing expectations. Consensus estimates were looking for job growth of about 550,000. However, some economists said that despite the disappointing unemployment data, it was not weak enough to stop the Federal Reserve from increasing the pace at which it cut monthly bond purchases.

14 Wall Street analysts took part in Kitco News’ gold survey this week. 4 percent or 27 percent of the respondents expected that gold prices would rise. At the same time, bearish and neutral investors tied for a draw, each garnering five votes, or 36%. Meanwhile, 984 votes were cast in online Main Street polls. Of these, 501, or 51%, expect gold to rise next week. Another 319, or 32%, of voters said it would drop, while 164 voters, or 17%, remained neutral. Sentiment is down from the previous survey that showed 67% of Main Street is bullish on gold. This change came as gold prices tried to end the third week in negative territory. February gold futures were last traded at $1,777.10, down 0.6% from last week.

Where are the expected levels

Support at $1,760 an ounce is a critical level to watch, said Nicholas Frappell, global managing director of ABC Bullion. He added that if gold can hold above this level, he sees prices testing the short-term resistance at $1,811 an ounce. Frappel added that disappointing employment data and more COVID0-19 news will continue to support prices as the Omicron virus spreads. Forexlive. com chief currency strategist Adam Button said gold is on a bullish trend as fears of new COVID-19 continue to rise. He added that the new Omicron virus means weaker economic growth and looser monetary policy.

Although Powell stepped up his hawkish rhetoric last week and said it was time to “abandon” the word “temporary” when describing inflation, some analysts do not expect to see a significant change in monetary policy anytime soon. Adrian Day, head of Wealth Management, said: “We’ve been saying for some time that the economy is not as strong as some think, that inflation will likely last longer and will be stronger, and that the Fed lacks the courage to properly control inflation. “This is a perfect storm for gold prices,” he said.

Other analysts, however, remain unconvinced that gold can withstand rising expectations that the Fed will tighten monetary policy more aggressively than expected to fight inflation. Mar Chandler, managing director of Bannockburn Global Forex, said gold prices are seeing retest support at $1,750 in the near term as the Fed is still reducing its monthly bond purchases and trying to speed up this process. Ole Hansen, head of commodities strategy at Saxo Bank, said it was difficult for gold to bounce back as rallies face renewed selling pressure. “Gold’s unimpressive behavior continued for a week of unpopularity despite Omicron lowering Treasury yields and at least temporarily lowering the dollar as well,” he said.